- 15th January, 2025

- By Alyson Wavish

Q4 2024 WRAP-UP – THE CHRISTMAS QUARTER

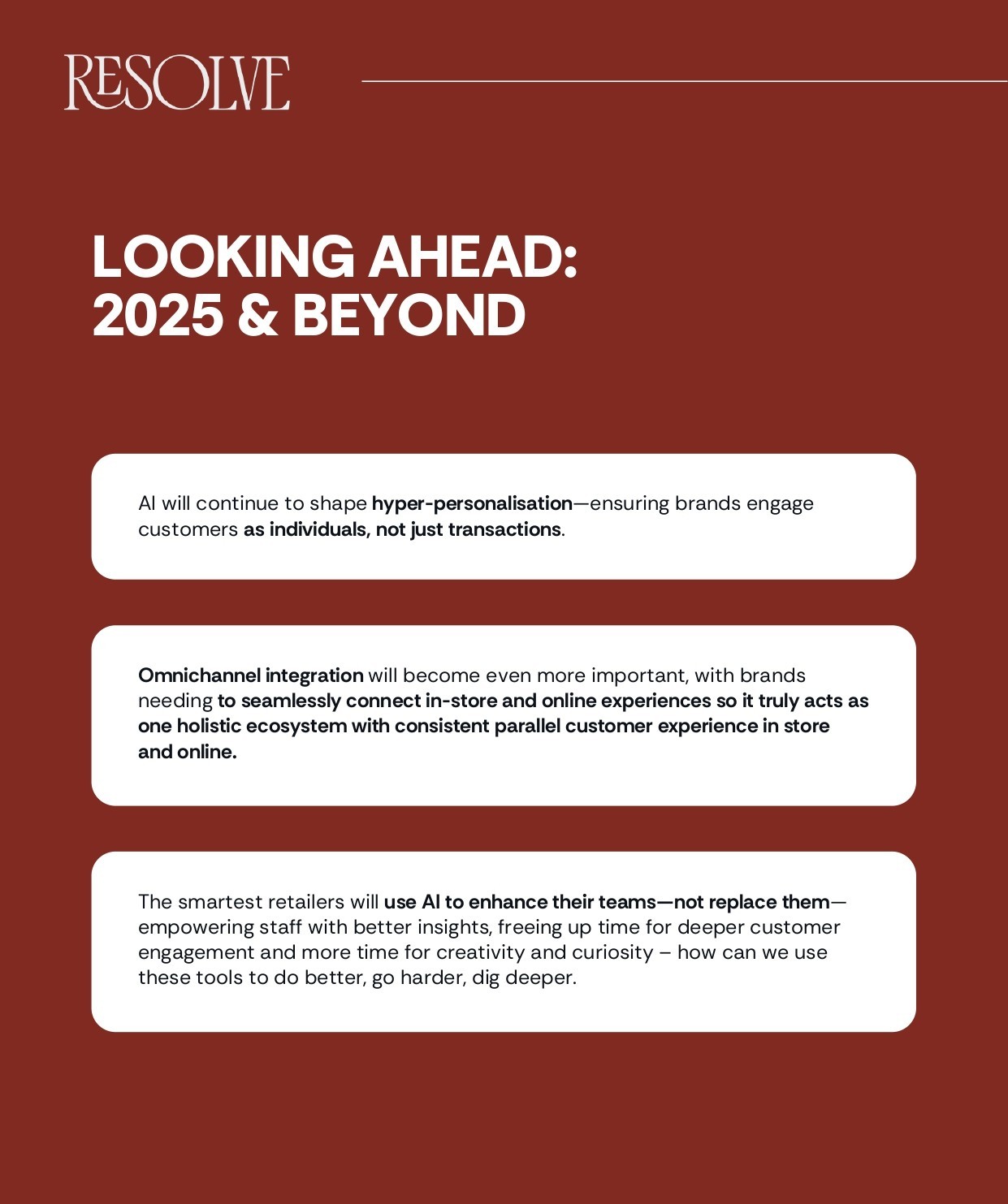

As we close out Q4 2024, one of the biggest discussions in retail is how Artificial Intelligence (AI) is shaping the industry—for better or worse. There’s still fear that AI is taking over, removing human connection, and making retail less personal. But from my recent travels to the UK, what I’ve seen is the opposite: when AI is used smartly, it enhances experiences rather than replacing them.

It was one of the aspects of my travels I was focussed on (given here in Aus, we’re still a bit cautious as always) – where can I see it being used to customer advantage and experience enhancement and where was it a bit “hmmm, not necessary”. And yes, there were a couple of examples of this too.

In a very brief summation though and my firm belief as I’m a curious nerdy beast who has been patiently awaiting working collaboratively with robots; AI is not here to take jobs—it’s here to free up time for strategy, creativity, and personalisation.

GLOBAL AI RETAIL TRENDS:

Amplifying the Human Experience

| AMAZON HAIR SALON, LONDON In Spitalfields, this salon’s AR-powered smart mirror lets customers preview different hairstyles before committing, reducing decision stress and enhancing satisfaction. No more thinking the Jennifer looks good on everyone (Yes I’m revealing my age and yes I was a Friends fan) |

| SAMSUNG KX, COAL DROPS YARD If IKEA built a tech experience, this would be it. Samsung KX is a fully immersive smart home showcase, demonstrating how AI integrates seamlessly into daily life. The space is set up as a walk-through home, with AIpowered smart kitchens recommending recipes based on fridge contents, a connected living room displaying realtime entertainment customisation, and AI-assisted fitness zones that adjust workouts based on your biometric data. It’s not just a showroom—it’s a glimpse into the future of connected living. |

| ZARA, LONDON Zara is pushing the boundaries of real-time in-store personalisation. AI-enabled tools like smart mirrors and mobile apps bridge the gap between online and in-store shopping. Customers can scan items in-store, receiving instant recommendations for matching or alternative products based on their style preferences. Pick up a floral dress? The AI suggests handbags, footwear, or jackets that complement the look—mimicking the personalization we’ve come to expect online but in a physical retail space. The common thread? These brands use AI to empower the customer, not replace human interaction. |

CLOSER TO HOME:

We are seeing some good AI examples in Australian Retail

| Woolworths | AI in its Everyday Rewards app personalises shopping recommendations, making grocery shopping more relevant and tailored. |

| The Iconic | Uses AI-driven fashion suggestions and sizing tools, reducing returns and improving the online shopping experience. As recently as last quarter, they rolled out a new AI powered “Wear it With” algorithm, which helps to inspire customers with suggestions on complementary products. |

| Coles & Kmart | AI–powered store layout analytics help retailers design better spaces and improve customer flow. |

| Bunnings | Bunnings has been at the forefront of tech experimentation for a long while, so it’s only fitting that as recently as a couple of weeks ago, they’ve taken their AI integration to the next level. By analysing 10 years of weather data through their Snowflake-based enterprise data platform, Bunnings can now predict purchasing trends based on local weather patterns. This means they can tailor their marketing and in-store merchandising to better meet customer needs, ensuring that the right products are available at the right times. It’s a brilliant example of using AI to enhance the customer experience by anticipating demand and personalising offerings. |

RETAIL SALES PERFORMANCE:

Q4 2024 Review

Page 4 www.re-solve.com.au Australian Retail Turnover Declines 0.1% in December 2024. Retailers Brace for a Cautious Start to 2025, despite the good news of a cut in the interest rates.

The latest seasonally adjusted figures from the Australian Bureau of Statistics (ABS) reveal a slight decline in Australian retail turnover, which fell by 0.1% in December 2024.

This marks a cooling period following robust growth observed in the preceding months, with turnover rising by 0.7% in November 2024 and 0.5% in October 2024. According to Robert Ewing, ABS Head of Business Statistics, "Retail spending held firm following strong growth in recent months with promotional activity stretched across the quarter." He also noted the impact of Cyber Monday, which fell in early December, boosting spending on discretionary items such as furniture, homewares, electronics, and electrical items.

This data suggests that despite the slight downturn in December, retail turnover has been on an overall upward conservative trajectory since 2019. The consistent increase in turnover highlights the resilience of the retail sector despite economic disruptions caused by the pandemic, albeit largely driven by inflation not volumes up until the last two quarters where we are seeing that uplift in volumes also. Volumes rose 1.0% in the December quarter of 2024. This comes after growth of 0.5% in the September quarter of 2024 and a fall of 0.2% in the June quarter of 2024.

This data suggests that despite the slight downturn in December, retail turnover has been on an overall upward conservative trajectory since 2019. The consistent increase in turnover highlights the resilience of the retail sector despite economic disruptions caused by the pandemic, albeit largely driven by inflation not volumes up until the last two quarters where we are seeing that uplift in volumes also. Volumes rose 1.0% in the December quarter of 2024. This comes after growth of 0.5% in the September quarter of 2024 and a fall of 0.2% in the June quarter of 2024.

While the slight decline in December 2024's retail turnover may raise some concerns, the broader trend indicates a resilient and steadily growing retail sector. Retailers must now align their strategies to maintain this momentum and address any potential challenges that may arise in the new year.

The pullback in December was largely driven by:

📉 Clothing, footwear, and accessories (-1.8%)

📉 Other retail categories (-1.4%)

📉 Cafes, restaurants, and takeaway (-0.5%)

But as mentioned antecedent, when we look at the quarter as a whole, the signs are good!

Retailers that performed well in Q4:

- Electronics & Homewares – Black Friday and Cyber Monday drove strong sales.

- Grocery & Essentials – Consistent spending despite economic caution.

- Health & Wellbeing – Continued growth in sportswear, supplements, and active lifestyle products. This is the biggest growth sector in Australian retailing at the moment and my prediction is it’s here to stay and only be amplified. ** If you are not looking at integration of health providers, products and services as part of your masterplan, you will miss out!

The good news? The Reserve Bank of Australia’s recent interest rate cut (0.25% in Feb 2025) will ease start to ease pressure on consumers, providing a potential boost to retail confidence heading into Q1 2025.

Outlook for 2025

Retailers are starting 2025 with cautious optimism, focusing on stabilising and leveraging the strong performance observed towards the end of 2024. Promotional activities, seasonal sales, and evolving consumer behaviours will likely play critical roles in shaping retail trends in the coming months.

As retailers navigate these early-year dynamics, industry stakeholders will be closely watching for signals of consumer confidence and spending patterns that could set the tone for the remainder of the year. With a focus on discretionary spending, retailers may need to adapt their strategies to cater to evolving consumer preferences and economic conditions.

Final Thoughts

AI isn’t the enemy of retail—when done right, it’s the ultimate enabler. It creates smarter shopping journeys, stronger customer connections, and more time for what really matters—strategic creativity, human engagement, and building communities. And that’s just front of house! We’re already seeing this in global flagship stores, Australian retail leaders, and even in our own business at Re-Solve.