- 12th March, 2025

- By Alyson Wavish

What Is the Data Telling Us, and Are the Shifting Trends Aligned or Working Against the Headwinds?

As we dive into Q1 FY25 retail results, the data tells a compelling story about how Australian consumers are adjusting their spending in the face of economic pressures, and how retailers can position themselves to still take advantage of this redistribution of discretionary spend.

With consumer sentiment improving, spending patterns shifting, and retail giants adapting, there’s plenty to unpack as we look ahead to the rest of FY25.

Key Trends and Takeaways from Q1 FY25

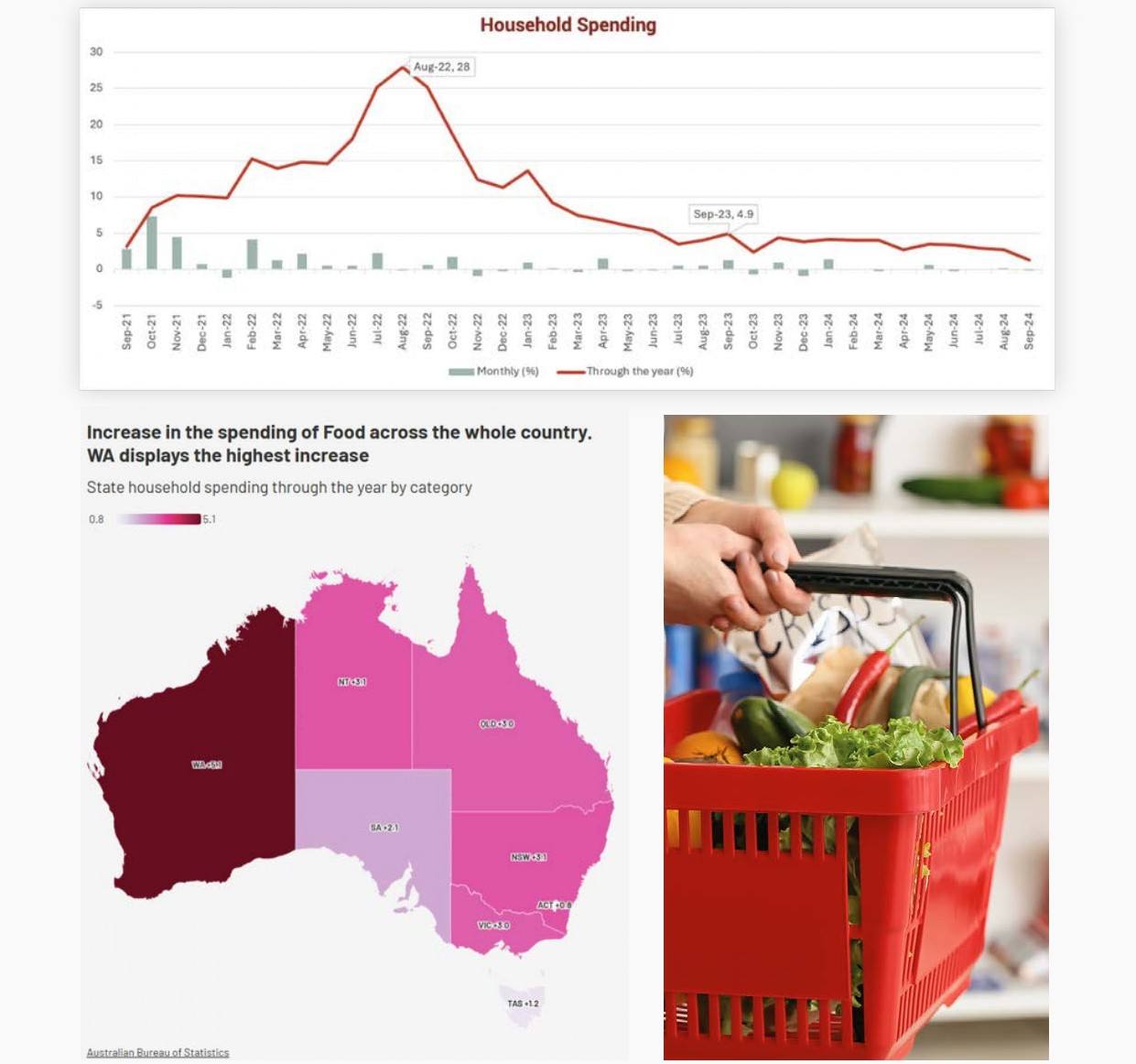

Consumers Are Spending Smarter: Essentials Up, Discretionary Down

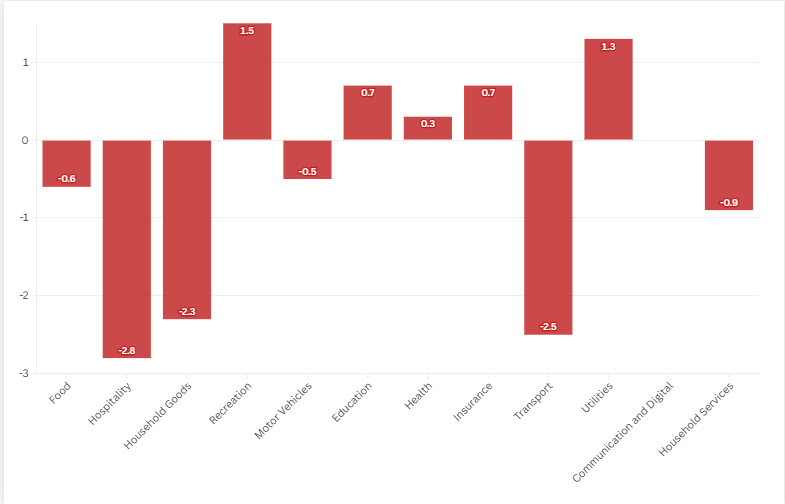

- Spending on discretionary items like clothing, transport, and recreation saw significant declines in September, dropping 3.5% month-on-month, while essentials like food and health rose modestly.

- This reflects how consumers are prioritising needs over wants, seeking value in everyday spending

Experiences Take the Spotlight

- Despite pulling back in some categories, consumers continue to prioritise experiences, with spending on travel, fitness, and education showing notable increases:

- Travel: Spending on online travel bookings, commercial airlines, and ticketing services surged, contributing to a 1.5% increase in recreation spending in September.

- Fitness Clubs and Gyms: Strong growth was noted in this category, reflecting the ongoing prioritisation of health and wellness.

- Education: Spending rose by 0.7% month-on-month, driven by universities, private schools, tutoring services, and vocational training. This underscores a shift toward long-term personal investment and upskilling.

For more detailed information on specific fluctuation indicators, click the button below:

Good News for Inflation and Interest Rates

- Inflation dipped to 2.8%, its lowest rate since March 2021, signaling better days ahead.

- The RBA kept interest rates on hold, a move that appears to be working, as consumers respond by rebalancing their budgets.

The Resilience of Australia's Big Retailers

Major ASX-listed retailers have had to respond and shift their thinking through strategic investments and adaptability, even as the broader retail environment remains challenging. Here’s a detailed look:

| Retailer | FY24 Highlights | FY25 Outlook |

|---|---|---|

| Woolworths Group | • Stable performance supported by its grocery division and investments in digital transformation. • 12% growth in fresh produce sales and 30% in home brand sales. | • Expansion of e-commerce and loyalty programs (e.g., Same Day and Cartology). • Higher costs expected (~$250m), including the acquisition of Petstock and PFD. |

| Coles Group | • 6.6% growth in fresh food sales, driven by strong trade during key events (Christmas, Black Friday). • 30.1% growth in e-commerce sales. | • Increased investment in omnichannel distribution and customer fulfilment centres. • Continued focus on supply chain improvements and risk management in geopolitical and climate change factors. |

| Wesfarmers | • Growth across Bunnings and Kmart, supported by technology and customer experience enhancements. • Focus on smaller, more networked stores and new revenue streams such as retail media networks. | • Increased investment in omnichannel strategies through OnePass and expanded health and retail networks. • Strengthened customer connection through personalisation and new partner collaborations. |

| JB Hi-Fi | • Strong demand for technology and consumer electronics sustained momentum throughout FY24. | • Focus on self-service, personalisation and service to retain competitive edge in challenging environment. |

| Myer Holdings | • Sales growth of 0.4% year-on-year, driven by the success of the Myer One loyalty program. • 2.1% of sales generated online, showcasing strong digital engagement strategy. | • Attracted 706,000 new loyalty members, with over 50% under 35s, reflecting a focus on younger demographics. • Plans to deepen customer engagement, increase store digitisation and align with younger demographics through search and visual discovery. |

| Kogan.com | • 23% growth in gross profit through margin recovery and loyalty program improvements. | • Strategic focus on expanding platform–based sales and launching new initiatives like The Mighty Ape Marketplace. |

What’s Ahead for FY25?

Positive Signs for 2024

With inflation easing and consumer sentiment up 5.3%, there’s growing optimism for a rebound in retail spending.

The renewed confidence, coupled with stabilising interest rates, points to steady improvement in the next three quarters.

Challenges Remain

Discretionary spending is still weak, and consumer budgets remain tight.

Retailers will need to focus on value, customer engagement, and strategic investments in

e-commerce and loyalty programs to maintain momentum.t three quarters.

However, there is still discretionary spending available. The key is how you position the value you create for the consumer. Instead of accepting that we're in a downturn, ask: How can I be more compelling? Shift the narrative from "Customers aren't spending" to "How can we better understand and meet our customers' current needs, as well as surprise and delight them?" Additionally, consider: "What are we best at, and how can we amplify that?"

Global Uncertainty

Geopolitical shifts, including the Trump administration’s policies, could ripple into global markets, impacting Australian retail.

However, the sector’s resilience so far is a promising indicator of its ability to adapt.

The Big Picture:

Resilience and Opportunity

While Q1 has shown some areas of decline, the examples set by Australia’s retail giants and the continued consumer focus on experiences highlight the sector's adaptability. The slowdown in discretionary spending has forced a reset, but the shift to smarter, more intentional purchases is an opportunity for retailers to innovate and deepen connections with their customers.

The philosophies are simple, and they remain the same for big and small retail: double down and triple down on customer experience and connections.

What does that look like? DON'T get rid of customer loyalty programs; enhance and elevate. I'm looking at you, café operators, getting rid of loyalty cards and putting up the price of coffee until you've actually priced yourselves out of the market. People have now opted to purchase coffee machines from JB Hifi and are making their coffees at home.

I'm also looking at you, fashion operators, who keep discounting so your clientele sit with their online shopping baskets on hold until they see you discount, and then they buy. You've conditioned consumers to wait for discounts and sales rather than rewarding or recognizing them for purchasing then and there.

The next three quarters of FY25 are shaping up to be pivotal. With positive signs on inflation and consumer sentiment, the groundwork is being laid for a recovery. Retailers that double down on loyalty, personalisation, and delivering value will be best positioned to succeed.

If you're not doing this already, the time is now. Invest in making this happen now so you're best positioned to ride the upswing when it hits next year. The best time to invest in shares is in a bear market, do the same with your business.

Contact Us

Do you have any questions?