- 29th May, 2025

- By Alyson Wavish

Australia’s Economy & Retail Sector: What Q3 Tells Us and What’s Coming in 2025 post Labor’s stronghold win

Hi everyone, here’s your straight-talking wrap-up of what’s going on with Australia’s economy right now, and what we can expect for the rest of the year.

Spending’s Up (But Not Everywhere)

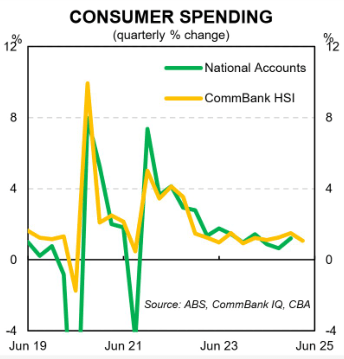

Household spending rose again in March, up 1% for the quarter though not as strong as late 2024. Essentials are still leading the way, with Insurance up 15.3% (premiums driven up by, Education 12.7%, and Health 11.9%. People are spending, but more out of necessity than choice.

Recreation and Hospitality got a boost thanks to major events like the Formula 1 Grand Prix. Online retail dipped in February (seasonal pattern), but it's still growing 12.2% year-on-year: a sign that consumer behaviour is adapting, not retreating. In February growth was driven by discretionary spending, which increased by 0.3%. However, non-discretionary spending experienced a 0.1% decline, as consumers spent less on Health (-0.1%), marking the first contraction in health-related spending since September 2024.

Inflation Slightly Creeping up

The Consumer Price Index rose 0.9% in Q1 2025, mainly driven by higher electricity costs, school fees and fresh produce. Annual inflation held at 2.4%, within the RBA’s target band; but the cost of essentials is biting.

To assist, as part of their election policy promise, the government has extended energy bill rebates, a much-needed break for households feeling the pinch. Another key economic stimulator will be importantly, over 3 million award wage earners including nurses, aged care workers and early educators receiving real wage increases. That’s more than 10% of the population seeing a direct improvement to their take-home pay, giving a welcome boost to spending potential.

| Weighted average of eight capital cities | Dec Qtr 2024 to Mar Qtr 2025 (% change) | Mar Qtr 2024 to Mar Qtr 2025 (% change) |

|---|---|---|

| All groups CPI | 0.9 | 2.4 |

| Food and non-alcoholic beverages | 1.2 | 3.2 |

| Alcohol and tobacco | 1.2 | 6.5 |

| Clothing and footwear | -0.8 | 1.7 |

| Housing | 1.7 | 2.2 |

| Furnishings, household equipment and services | -0.9 | 0.7 |

| Health | 2.9 | 4.1 |

| Transport | 1 | -1 |

| Communication | -0.3 | 0 |

| Recreation and culture | -1.6 | 1.7 |

| Education | 5.2 | 5.7 |

| Insurance and financial services | 0.5 | 3.8 |

Confidence Has Taken a Hit

Consumer confidence dropped to 90.1 in April, the lowest in six months. Business confidence also dipped, particularly in construction and finance, even though sectors like retail and recreation are showing pockets of growth.

We all know the cause… I know it’s a constant at the back of my mind… Uncertainty. From global trade tensions to U.S. tariff hikes (including on Australian beef), global instability is spooking markets. The ASX recently dropped 1.8%, with mining and consumer stocks sliding.

Post-Election Shift: Labor in the Driver’s Seat

With the majority win in the House, Labor has the runway to deliver policy at speed. It’s part of a historical trend: we know Australians often lean left during economic slowdowns, favouring stability, equity, and investment in public services.

Labor’s fiscal focus favours:

Targeted investment over trickle-down economics

Minimum wage growth, already underway

Support for education, health and clean energy sectors

This mirrors moments in history — Whitlam’s reforms in the 70s, and Rudd’s targeted stimulus during the GFC — where public investment helped reset consumer and economic confidence.

Education Tourism: A Double-Edged Sword

International education has been a lifeline for urban economies like Melbourne’s CBD, fuelling retail, dining and tech sectors. But it’s pushed up rental demand, pricing out many domestic students who are now living at home longer and cutting back on discretionary spending.

The government has responded with a key election policy: HECS-HELP debt relief. Indexation on student debt has been reduced, and many domestic students will see their loans shrink for the first time in years. Mark my words. THIS is a game changer: easing financial anxiety and creating space for more confident spending among young Australians. Not only that, parents having tertiary students staying at home longer and having to foot the bill may now see some pressure ease in total household available spending.

Gen Z: The New Retail Muscle

Gen Z now represents around 15% of the Australian consumer market, and they’re just getting started. With HECS relief, minimum wage growth, and better employment conditions, this group is poised to spend more; but only with brands that reflect their values.

We all know it and they influence the rest of the generations: They’re socially aware, digital-first and highly discerning. Brands that prioritise transparency, inclusion, sustainability and community connection will win their loyalty and their dollars.

I’ll say the COMMUNITY CONNECTION part louder for the people in the back. Performative is out (thank the proverbial universe because I’ve always been a non-advocate) and community, authenticity, reality is IN and it’s to stay.

Looking Ahead: The Rest of 2025

- Consumer Confidence: Likely to recover gradually if wages outpace inflation and global conditions settle

- Retail Sales: Stable growth expected in food, health, tech and value-led fashion. Big-ticket and discretionary goods may remain sluggish until confidence lifts

- Housing Pressure: Without faster intervention, affordability will stay a barrier for young renters and buyers — a drag on both household mobility and discretionary income

- Labour-Led Policy: Expect continued support for essential workers, infrastructure and services, with an emphasis on equitable growth and wage fairness

Another signal of economic easing came with the Reserve Bank of Australia's recent rate cut: a move designed to take pressure off household budgets and help drive confidence.

While not all banks passed on the cut in full, ANZ and NAB have made adjustments to home loan rates, with CBA and Westpac offering partial relief. What does this mean for you and your customers? Lower repayments = more discretionary income. But don’t mistake this for a retail boom; consumers are still cautious. It simply means the right message, the right timing, and a values-aligned brand will convert better. Watch your margin, but don't pull back.

What This Means for Retailers

Now is the time to get on the front foot.

Retailers who are:

Values-led

Digitally engaging and immersive

Affordable but high quality

Sustainable and inclusive

...will benefit most from this emerging upswing, especially from Gen Z consumers and young families re-entering the spending cycle.

The second half of 2025 offers a runway for growth; but only for those prepared. Let’s stay curious, stay connected, and make the most of the signals that matter.

OK Now for the HOW and also the more Fun part of my newsletter!

The 'S' That Sticks: 3 Proven Social Impact Tools Built by People Who Get It

I get asked this a lot — “How do I give back in a way that’s real, easy, and doesn’t chew up all my margin?” The good news? You can do it in a way that boosts profitability, not drags it down.

Here are three of my favorite plug-and-play tools for every business model: online, bricks-and-mortar, or omni.

1. **GoGenerosity** (Shopify plug-in, NZ/Aus-based):

Created by my mate Rohan McCloskey across the ditch, GoGenerosity makes it ridiculously simple to let your customers pay generosity forward. Shoppers can add donations at checkout, which are turned into full-value digital vouchers that go to charity partners. It’s generosity made scalable and traceable.

✔100% of donations go to the cause

✔ Increases revenue and customer loyalty

✔ Impact stats you can market with integrity

✔ Turns your store into a purpose-led brand

✔ Shopify plug-in; seamless onboarding

Customers are 4x more likely to buy from a purpose-led business. 70% of Gen Z check your values before they even consider you. If you're not doing this: you're already behind. I’ve said it in just about every article I’ve written or spoken about… getting the memo?!

2. **Doing Good Rewards** (in-store & omni-channel):

Built for bricks-and-mortar and retailers who want to show social value in hard numbers. Doing Good Rewards works like a loyalty program but better. Every time a shopper buys, a percentage goes to their chosen cause. It’s measurable, impactful, and easy to integrate.

✔ Drives loyalty and frequency

✔ Live dashboard + compliance sorted

✔ You choose the causes you support

✔ Works with existing POS and digital systems

Fun fact: 89% of customers would switch to a brand associated with a good cause. This one ticks every box.

3. **Firefly Initiative** (Local volunteering & social impact):

https://www.fireflyinitiative.xyz/

Post-COVID, volunteering has taken a massive hit across Australia. The Firefly Initiative helps retailers plug into their local community: whether that’s sporting clubs, schools, neighbourhood centres, or local tourism events. Volunteers are the invisible engine of the economy. Firefly makes it easy to connect, contribute and report on your social footprint.

✔ Reverses the volunteer shortage trend

✔ Drives community foot traffic

✔ Deepens brand trust and connection

✔ Works with existing POS and digital systems Perfect for ESG and grant reporting

These are three easy wins. Choose the right fit for your business. Try it. And if you're still unsure where to start: hit me up as I have partnered with all 3.